Awareness Programme for Financial Literacy & Digital Banking Services in Rural India

SBI Youth for India (YFI) has partnered with 14 reputed NGOs, among which I have been placed with Samaj Pragathi Sahayog (SPS), which has been working in the drought-prone tribal belt of the Dewas district under various interventions of rural livelihood, watershed, livestock, and women empowerment.

Catalysts of Change: Empowering the Community

As I stepped into the role under the guidance of SPS and its dedicated staff, a tapestry of interventions spanning three decades unfolded before me. Witnessing the profound impact these initiatives have had on the community's living standards was enlightening. This transformation has fostered unwavering support for SPS, painting a portrait of a united community backing a shared cause.

The established rapport between the NGO and the community played a pivotal role in my smooth transition, fostering acceptance within the heart of Salkethya village. With its 50 houses, this village has been touched by SPS's primary interventions, which encompass self-help groups (SHGs), agricultural advancements, and the critical facets of health and nutrition. This journey is a testament to the power of collaboration, as we collectively work towards a brighter future for Salkethya.

Empowering Women: Fostering Financial Independence

Our primary intervention has led to the formation of three Self Help Groups (SHGs), which have become the backbone of the village community. As I spent time with these remarkable women, it became evident that there is a significant dependency on external parties for their personal and commercial financial activities. The foundational banking functions, such as passbook entries, balance checks, and loan interest calculations, are still being managed through traditional channels, often relying on the assistance of field executives from the NGO.

Unfortunately, this over-reliance on external support undermines the goal of making these women self-reliant. They continue to face challenges in handling these processes independently. Moreover, this dependency has created opportunities for misuse of funds by others, leading to financial setbacks for these women. Recognizing this critical issue, I embarked on a project focused on empowering the women of these SHGs through comprehensive financial literacy and digital (e-services) training.

Also Read: The Crisis of Farmer Suicides in India: Understanding the Issue and Exploring Solutions

Bridging the Digital Gaps across a wide landscape

In the realm of digital financial services, an array of apps and platforms, including UPI (Unified Payments Interface) and BHIM (Bharat Interface for Money), have emerged, promising to streamline financial activities and save valuable time and effort. However, the question remains: Are these services equally accessible to all demographics? As we discuss the transformation of India into a digital era, it's crucial to acknowledge that a significant portion,around 80% of the village community, particularly women, still rely on basic feature mobiles rather than smartphones. Smartphone ownership remains a privilege, often limited within households.

Interestingly, it's the women of the house who typically manage the family's financial activities. Yet, notable gaps persist in terms of access to resources, efficient time-saving methods, and reduced dependency on external organizations like NGOs. Recognizing these challenges, I've taken it upon myself to address these gaps, fostering inclusivity and empowering the community with essential financial knowledge and digital skills, thereby bridging the digital gap in rural India.

Empowering the Heroes: Balancing Household and Field Duties

In the daily lives of women, managing household chores and fieldwork is a non-stop endeavor. Their responsibilities include everything from taking care of the house, kids, crops, and cattle. Finding time to learn essential skills like financial literacy can be challenging, and it's often hard for them to step away from their work. Despite expressing occasional moments of free time, a closer look reveals that their day starts at 5 AM, filled with a continuous stream of tasks, from feeding cattle to field-related work, leaving them little respite. Recognizing their dedication, I'm working to bridge the gap, empowering these women with digital banking services that fit into their busy lives.

Empowering Women's Financial Literacy

Navigating through a power-packed schedule, these women not only handle daily chores but also have to make time for SHGs meetings and visits to the bank for tasks like passbook printing and balance checks. Despite the convenience of touch-screen digital banking services, access remains a significant gap, often perceived as a gender issue. Teaching them the significance of financial literacy and E-services presents its challenges. Through continuous persuasion, I managed to organize a small evening class for a group of 10 women after 7:00 PM. They dedicate an hour to learning, and then rushing back home to prepare dinner for their families. Sometimes, they join around 7:30 PM, as their cattle return from the fields, which limits the time available for our valuable class sessions.

Also Read: Traditional Knowledge Facing the Barrier of ‘Conventionalism’

Breaking Down the Project

The essence of my project lies in imparting financial literacy and fostering awareness about digital banking services within the community. However, this task poses unique challenges due to the prevalence of feature phones among the majority of the community members. These phones, while limited in functionality, can still provide specific actions such as checking balances and receiving transaction notifications via SMS. It's essential to note that many beneficiaries are illiterate, and not familiar with either English or Hindi, which is the language used by the services we introduce.

Recognizing the power of storytelling, I discovered a compelling approach to capture their attention and convey our message over an extended period. The first step in my training process involves raising their awareness by delving into their financial transactions by reading their passbooks. Yet, let's admit it, reading financial statements can be monotonous. The challenge was in making them truly understand. Fortunately, spending time with the community paid off, as I integrated storytelling into my approach. Early in my journey, I uncovered a strong belief in religion, with tales rooted in the mythology of the Narmadha valley, the very region we find ourselves in. These stories served as a bridge, drawing them closer to the financial concepts we were introducing and creating a lasting impact that resonated deeply within the community.

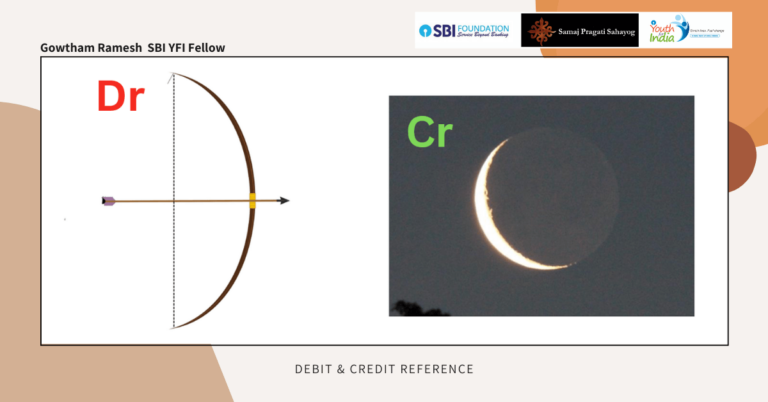

Unveiling Financial Concepts: Debit, Credit, and the Passbook Secret

Let's demystify the language of finances using symbolism. Imagine "Debit" (D) as a poised BOW, ready to fire an arrow. This arrow, representing your money, leaves your hand and hits its target. Similarly, Debit (Dr) performs the same function, causing your money to leave your account.

Now, let's explore "Credit" (C) with a symbolic twist. Picture it as a crescent moon, a symbol of auspiciousness during Amavasya and Purnima nights. This connection makes them see "Credit" as a positive sign, akin to receiving money on these special days. Just as the moon brings light to the night, Credit (Cr) brings money into your account through deposits, interest, and transfers received.

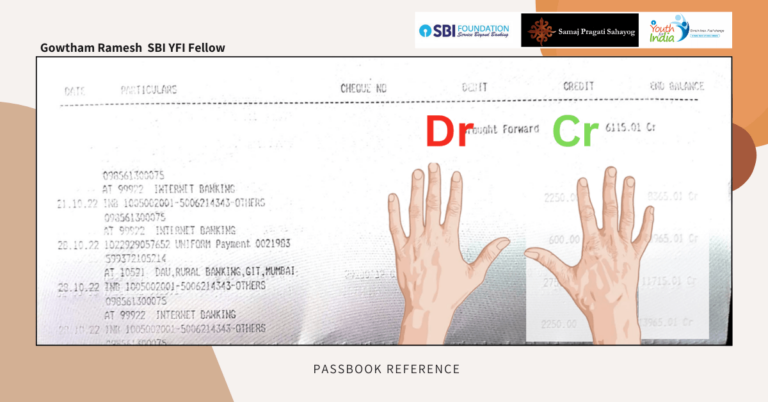

In the world of financial literacy, we've found a unique teaching tool. A concept rooted in our practice - using only the right hand for giving and receiving money, not involving the left hand in financial activities. This teaching approach has proven effective in helping them read their passbooks with ease.

When we open the passbook, the header row reveals essential information: Date, Particulars, Cheque No, Debit (Dr), Credit (Cr), and End Balance. By placing both hands on the book for Debit (Dr) and Credit (Cr), a concept takes shape: the left hand signifies Debit, representing the arrow of money leaving the account, while the right hand represents Credit, acting as the receiver of money, symbolizing funds entering your account. This simplifies the concept of Debit and Credit, making financial statements easier to understand.

As we continue this journey, stay tuned for more insights. We'll delve into the world of mobile apps and icons in another opportunity, enriching their grasp of financial literacy even further.

Also Read: Social Entrepreneurship is Growing Among Youth in Cities

Journey of YFI

SBI Youth for India is a flagship program of the SBI Foundation I can see why this has crossed 10 years and how it has withstood the time in producing effective results in the life of the community and as well as the Fellows. This 13 months of experience cannot be described as the highs and lows of YFI

- Love and care from a complete stranger who feeds me food three times a day.

- Feeling homesick and a misfit at times.

- Having conversations with the community in a new language for hours.

- Learning to cook for the first time and preparing meals for friends.

- Having a routine and managing the day-to-day activities.

- Time to do self-reflection.

- Making lifelong memories and experiences to treasure.

These are a few of the things I can say about my experience of how this YFI has transformed my life from a Tier-2 citizen to becoming a member of the community and my voice being heard on important tasks and activities of the community.

YFI has given me many life learnings that I would never have experienced in my life, cooking, communication, planning, and taking care of myself are some of the personal learning I would be grateful for throughout my lifetime. The small impact that we have created through the project has been felt and recognized by the community how they come together to help you is the only statement I could say of the experience.

Also Read: Discussing Gender Discrimination in Rural Areas of India

Board Meetings are ineffective

As an enthusiastic Fellow, you come with a whole plan to change a lot of things, bring a change through the project and improve the livelihood. We have a lot of ideas and plans to execute to make their lives easier but every idea and plan cannot be done in 13 months it takes time. But, once you hit the ground, you will realize that people already don't have time at all; the time they have has been used to live their life, earn money for themselves and their families. Intervention and changes take time, you might create a foundation, and it might grow into something big down the lane.

Give your 100% in every effort people know very well what your objection or final thing you expect from them, and the effort you put in will translate into success down the lane. In some way or another way, these efforts convert into action. I used to attend all the meetings and spend time with them just to share my ideas. The community noticed the efforts, and when I was planning to conduct a night class community came together to mobilize them for the session. Always be open to ideas, thoughts, and other beliefs try to understand why it's important for them you might create a 13-month project plan, but in the field, they might have two months of harvest, labour works, festivals, and other important aspects of the community.

CTC - Checklist to Carry

Try to enjoy your Fellowship with an open mind, attend all the events and activities, be one with the NGO in the goals and how the NGO envisions your project, and cooperate with the field to get the learning and results. YFI Fellowship is a once-in-a-lifetime experience that helps you to push yourself in every aspect of life.

Be happy! Enjoy the journey!